Core Inflation Has Not Increased In 12 Months, but It Has Become More Predictive: Labor and Consumer Prices in the Light of Lower Interest Rates

Officials are trying to strike a delicate balance: They want to slow the economy enough to make sure that inflation is fully stamped out, but without hitting the brakes so hard that growth grinds to a halt and workers unnecessarily lose jobs.

Even if the Fed doesn’t raise interest rates this week, they can signal their intent to do so later in the year by forecasting higher rates. Powell may stress at his post-meeting news conference that rates will remain elevated until inflation is under control.

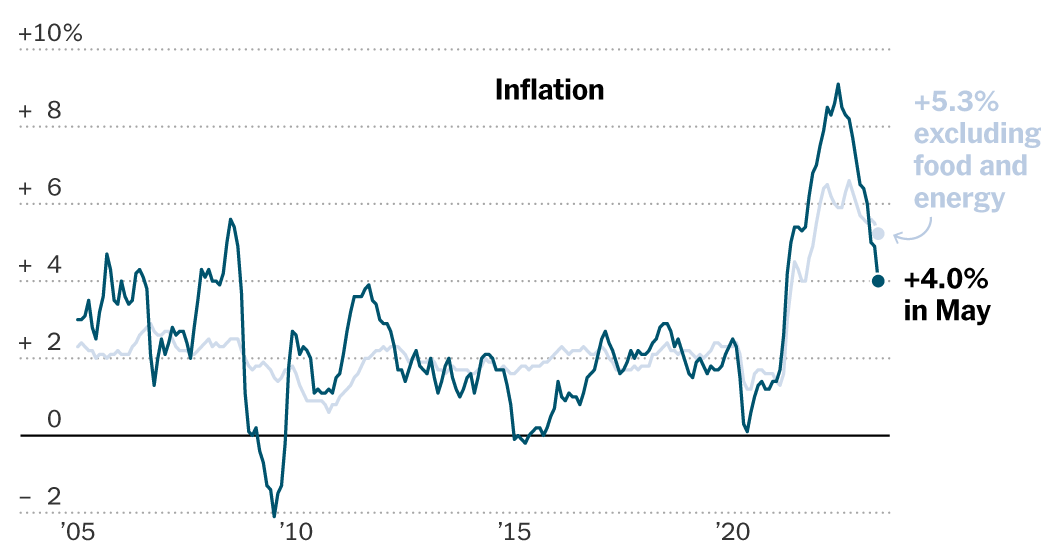

Excluding volatile food and energy prices, “core” inflation was 5.3% for the twelve months ending in May. Annual inflation has dropped significantly since last summer, when it hit a four-decade high of 9.1%. But while the price of many goods has leveled off or even fallen, the cost of services such as restaurant meals and car repair continues to climb.

That cooling comes as costs for some key services climb more slowly or even decline. Rental inflation has long been expected to cool off, and that is beginning to happen. Airfares came down sharply last month, and a range of recreation-related purchases — from movie tickets to pet care — moderated in price.

The fresh data show that the Feds push to control rapid price increases is beginning to work. Fed officials have been making it more expensive to borrow money in a bid to lower consumer demand and slow inflation, which they say is caused by a strong labor market. They have lifted borrowing costs for 10 meetings in a row, to just above 5 percent, and many officials have suggested in recent weeks that they could soon take a pause to give themselves more time to assess how those adjustments are working.

“They are probably feeling a little bit relieved,” Laura Rosner-Warburton, a senior economist at MacroPolicy Perspectives, said. The report has encouraging and discouraging information for policymakers, but it keeps them on track to raise rates again.

While that remains about twice the rate that was normal before the onset of the coronavirus pandemic in 2020, it is down sharply from a peak of about 9 percent last summer.

A Labor Department report Tuesday shows that consumer prices in May were 4% higher than a year ago. It was the smallest annual rise in almost a year.

Inflationary Phenomenology in the First Three Months of the Fed’s Second Quarter Quarter Results and Implications for the Price of Services

The inflation report the Federal Reserve received on Tuesday was very encouraging and could give comfort to policymakers that the interest rate increases in June won’t be as steep as expected.

“I think that they have an opportunity to either pause or skip here, which is what I think you would call it,” he said. I believe Powell Chair will emphasize the need to get inflation back down, given how long they can stay at whatever level it is.

The falling price of eggs and gasoline made a difference in inflation last month. But the overall cost of living is still climbing uncomfortably fast.

Prices rose 0.1% between April and May, a smaller increase than the month before. Rising rents and used car prices were partially offset by cheaper gasoline and electricity.

Investors are betting that the Fed will leave interest rates unchanged at this week’s meeting. But additional rate hikes could follow if inflation remains stubbornly high.

“We believe the Fed has more work to do,” Patterson said. “Inflation is better than 9%, but it’s still a long ways away from their 2% target.”

The central bank has a challenge with inflation being a moving target. Just as a single source of pocketbook pain can be solved, there can also be other sources of pain.

The spike in energy prices after Russia invasion of Ukranian have returned to the ground. Egg prices have fallen because of a rebound in flocks of laying hens.

“Supply chains have normalized,” says White House economist Ernie Tedeschi. “And that seems to have translated into goods inflation that has trended down.”

But as Tedeschi and his colleagues acknowledged in a recent blog post, inflation around the price of services “has remained elevated in recent months and is unlikely to be resolved by lessening supply chain frictions alone.”